Only a few hundred meters from Singapore, the sleepy fishing villages that flank the Malaysia-Singapore Second Bridge, to the west of Johor Bahru’s famous Iskandar development, feel a world away from skyscrapers and hustle.

But this is set to change. Country Garden, one of China’s largest real estate developers, has bought a huge 1,800 hectare area of land and sea, and has made progress on developing “Forest City”, a planned mega-project almost entirely built on four separate reclaimed islands.

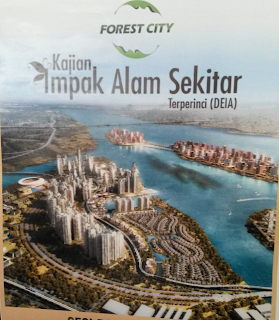

When completed, it would be even larger than Singapore’s Sentosa Island and have a skyline reminiscent of Dubai or Shanghai’s Pudong district (see photo).

It would add to Country Garden’s existing project (under construction) in Johor Bahru’s Danga Bay which, although occupying a comparatively small 22 hectares of reclaimed land, is already Johor state’s largest standalone condominium project, delivering over 9,000 housing units upon completion by 2017-2018.

Forest City takes it to another level, however. Official blueprints envision scattered assortments of residential-commercial-retail districts, a new football stadium, and sports centers, with a potential gross investment value of up to $150bn. The photo below shows the area in its current state.

As a 66/34 per cent joint venture between Country Garden and the sultan of Johor, it is reportedly lobbying the federal government for lower corporate income tax to entice investment from foreign multinationals. According to local representatives of Country Garden, the company’s CEO, Yang Guoqiang, has “always dreamed” of undertaking a project such as this.

Opposition from Singapore

The sheer scale of the project has led to some degree of opposition. Most notable are the concerns of Singapore. While Forest City does not cross the water boundaries between Malaysia and Singapore, large-scale dredging would nevertheless impact water flows and silting through the channel.

Earlier this year, the Singaporean government demanded a thorough environmental impact assessment (EIA) and in late November renewed its complaints to the Malaysian federal government, calling for all reclamation work to be further suspended.

Malaysia’s Department of Environment deferred a decision that had been due last week on whether and in what form the project could be carried out. The deferral followed recommendations by a panel of experts on ways to minimise the environmental mpact on the Straits of Johor.

There is growing local opposition to the project, too. Fishing communities are upset about potential detriments to their livelihood, while the project effectively impedes the future development of the adjacent Port Tanjung Pelapas, Malaysia’s second largest port, which was previously planned for future expansion along the coastline.

The lack of public consultation has raised some eyebrows. While the land acquisition process itself has been smooth – owners of coastal land have happily sold most of their holdings for a hefty premium –land usage is heavily influenced by the sultan of Johor, who effectively is selling mostly “reclaimed sea”, despite Johor state’s abundance of unused land.

In addition to Country Garden, other major Chinese developers such as Greenland Group and R&F Properties are also developing large mixed use projects entirely on reclaimed land – and directly overlooking Singapore.

The biggest fear is that Forest City may tip the balance in Johor’s already-distorted real estate market. The recent entrance of condominium developers has led to a near quadrupling in land prices along the coast, with ramifications throughout the Johor area. R&F Properties, for example, recently paid MYR900 per sq ft for a stretch of sea close to the Malaysia-Singapore borderline. Just three years ago, prices were barely at MYR250 per sq ft in this area, industry experts said.

Can the surging prices continue?

The question is whether the astronomical price growth can continue, and whether these developers can successfully turn profits. For example, valuations would require condominium prices to increase at least another 30 to 40 per cent for R&F’s investment to breakeven.

For sure, developers have mainly viewed Iskandar and Johor through the prism of a Singapore proxy, and as a test case for future overseas expansion in other markets. Although average condominium prices are already in line with Kuala Lumpur (which has a higher average income), prices are still at a fraction of those in the city-state next door.

Growing connectivity across the straits – including the planned Malaysia-Singapore high speed rail and a proposed extension of Singapore’s MRT – lend support to the notion that this price gap will narrow over time, particularly given Malaysia’s practice of granting permanent residency to some foreign buyers.

The recent weakening of the Malaysian ringgit could also help promote this investment thesis. Nevertheless, increasingly out of reach of most local buyers, these projects may not be able to rely on foreigners alone.

By law, foreign property buyers are required to take out mortgages from Malaysia-domiciled banks. However, mortgage lending is facing growing caps, while buyers from mainland China are reportedly facing new restrictions due to banks’ inability to verify documents.

Buyers from Singapore are also increasingly worried about issues such as building management, landscaping, and other “soft” elements of real estate. With fears that the growing supply glut – including at least 10,000 new condo units in Iskandar’s Medini area from mostly local developers – could result in price wars between competitors, many existing players are pulling back new launches.

Already, average local house price indices (subject to revision) in Johor have seen moderate dips in the last few months. Given this environment, whether Forest City will proceed – at least according to its current blueprint – remains unclear.

Land reclamation has already begun near the Second Malaysia-Singapore Link, while huge parcels of land and forest have already been cleared by Teng Yue Construction, the main contractor for Country Garden.

A bilateral issue?

According to officials at Teng Yue, all further reclamation will be delayed at least until the first quarter of 2015, both due to Singaporean objections and the impending monsoon season. Singapore’s complaints, however have been directed towards the federal government in Putrajaya, not to the sultan of Johor.

The two governments have had a history of disputes over reclaimed land in the past, including Malaysia’s objections to Singaporean reclamation works around Tekong Island on the east side of their channel, which in 2003 resulted in a modification of Singapore’s original plans.

In theory, the federal government has the power to block or stall mega-projects such as Forest City. However, the political dissonance that has been created as a result of falling public support for Umno – the leading party in Malaysia’s ruling coalition – has effectively granted greater individual powers to state sultans. It is unclear, therefore, to what extent Putrajaya would be willing to embarrass Johor’s royals in order to do Singapore’s bidding.

In the meantime, Country Garden is trying its best to shore up its image amongst local Johoreans. It is now the lead sponsor of the local football team, in one of Malaysia’s most football-mad states.

Gavin Bowring and Hafiz Noor Shams are staff at Asean Confidential, a research service at the Financial Times.